The real estate market is experiencing new dynamics this spring, as home prices continue to rise and inventory remains low. Home sellers are facing a challenging market. In a recent survey conducted by Realtor.com, more than 1,200 recent or potential home sellers shared their views on the current market.

"Locked In" by Low Mortgage Rates:

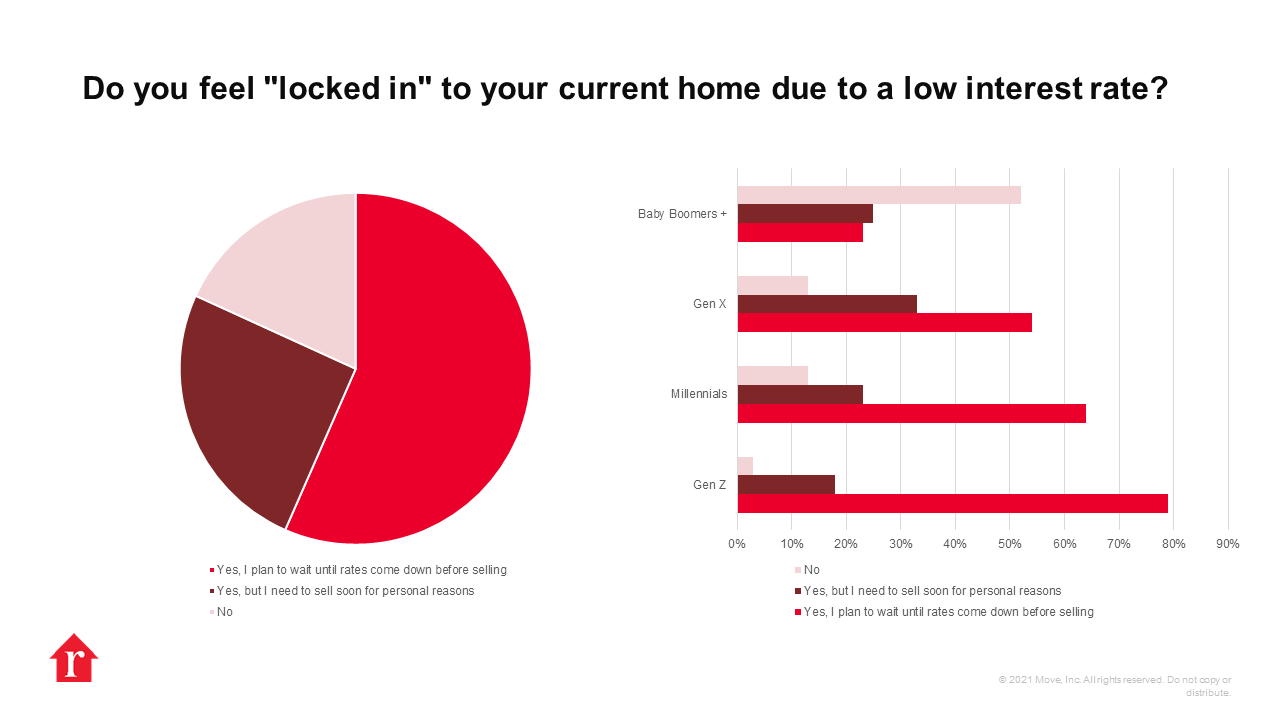

More than three-quarters of sellers feel "locked in" to their current homes due to low mortgage rates. This feeling is most prevalent among younger generations who have more significant outstanding mortgage debt as they contemplate their next move. The vast majority of Gen Z, Millennial, and Gen X owners surveyed feel locked in by their current mortgage rate, with 97%, 87%, and 87% of owners citing this feeling, respectively.

Waiting for Rates to Come Down:

More than half of sellers surveyed plan to wait until rates come down before selling, despite feeling locked in. This is a reasonable decision, as a lower mortgage rate can significantly reduce the total cost of borrowing and help sellers afford a better home. However, with interest rates projected to rise, it is unclear when or if rates will come down.

Selling Soon for Personal Reasons:

Despite feeling locked in, 25% of sellers surveyed plan to sell soon for personal reasons. These reasons may include changing family needs, a desire for different amenities, or the potential for a profit. A third of Gen X owners plan to sell anyway, perhaps because they have lower amounts of outstanding debt. On the other hand, among Baby Boomers who likely have the least debt, the majority do not feel locked into their current home by a low-interest rate.

Feeling "Locked In" and Home Equity:

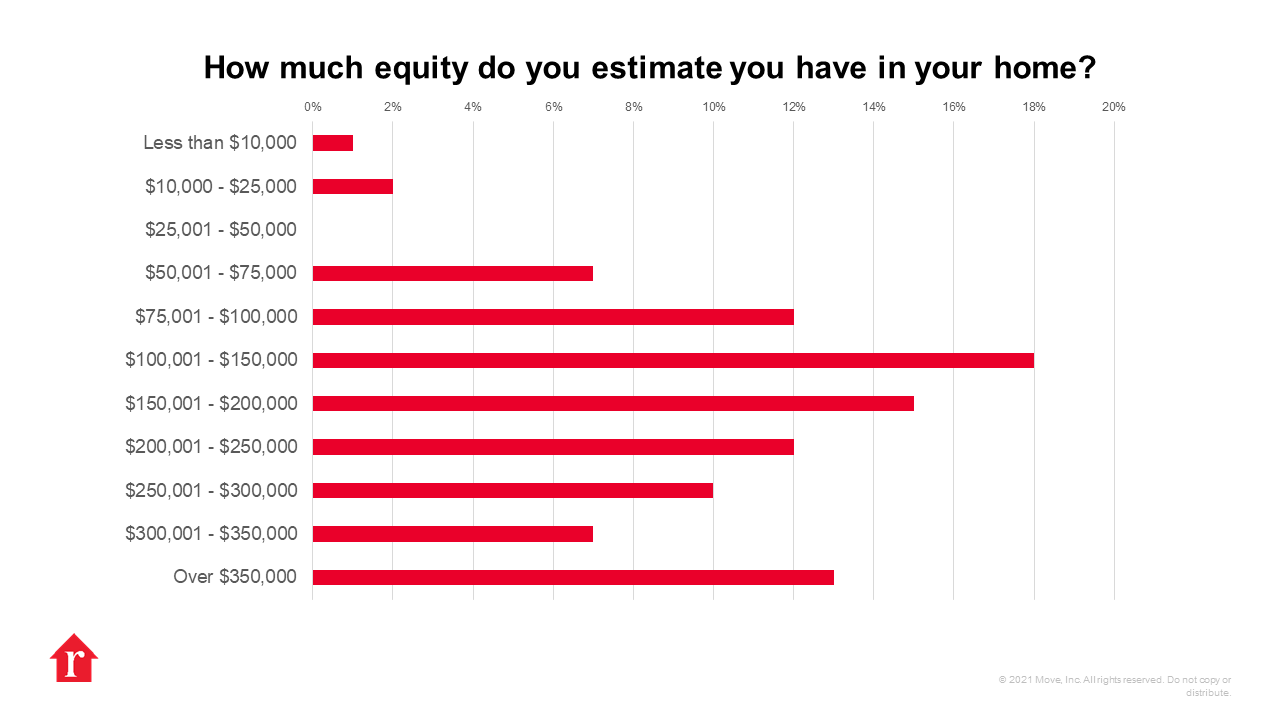

The feeling of being "locked in" is understandable, but homeowners can take comfort in the fact that they have a near record-high level of equity in their homes. According to the survey, 85% of sellers are happy with the amount of equity they have in their homes, with three-quarters estimating they have over $100,000 of equity and 42% estimating more than $200,000 of equity. Homeowners who choose to sell can use this equity to put down a larger down payment on a new home, which can help offset the higher mortgage rates.

Conclusion:

In conclusion, the current real estate market is challenging for both buyers and sellers. Low buyer demand means homes sit for longer, and low affordable inventory means buyers are struggling to participate in the market. The feeling of being "locked in" due to low mortgage rates is prevalent among homeowners, especially younger generations. However, homeowners can take comfort in the fact that they have a near record-high level of equity in their homes, which can help offset the higher mortgage rates. Overall, homeowners should carefully consider their options before making any decisions and work with a trusted real estate professional to navigate the current market.

Enter your text here...