Key Takeaways:

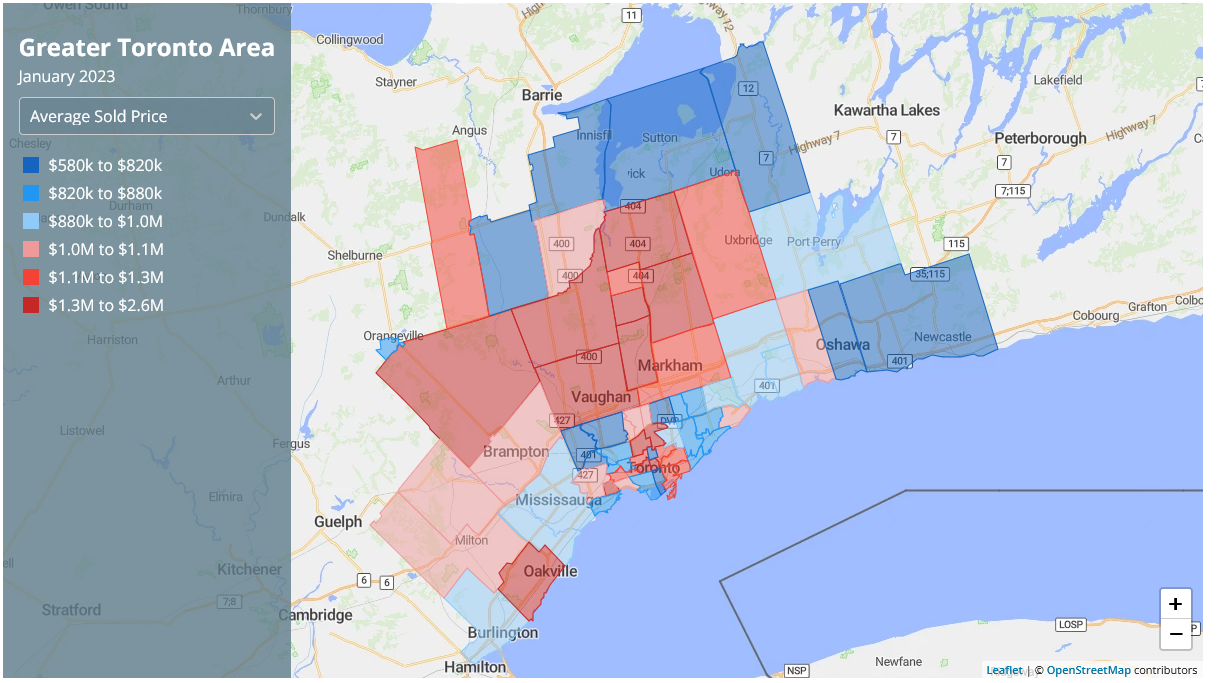

- High housing costs in Canada prevent many from homeownership, with average prices at $612,204 and up to $1,000,000 in Toronto.

- Innovative approaches can improve affordability,

- 40-year amortization can help younger, lower-income Canadians become homeowners.

- Higher investor down payments can level the playing field for first-time buyers.

- Tax incentives for mortgage interest can reduce the cost of homeownership and incentivize first-time buyers.

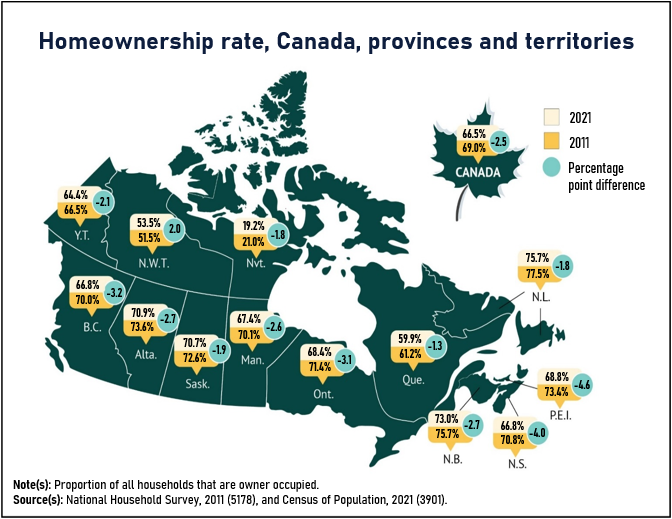

For many people in Canada, owning a home is a lifelong dream. However, it is becoming harder and harder for first-time homebuyers to buy a house because the cost of living is going up and house prices are getting higher. In 2021, the average price of a house in Canada was $612,204. In some places like the Greater Toronto Area, prices were as high as $1,000,000. This means that it is really hard for many Canadians to afford a home. In fact, the number of Canadians who own homes has gone down by 2.5% since 2011.

To help more people buy homes, we need to find new and creative ways to make housing more affordable and remove the barriers that make it hard for people to buy homes. There are three strategies that can help more Canadians afford a home.

Offering first-time homebuyers a 40-Year Amortization:

The first strategy is to give first-time homebuyers the option of having a 40-year mortgage. This means that people can spread out their mortgage payments over a longer period of time, which makes them more affordable. This can help younger Canadians who are just starting out in their careers and don't make as much money yet.

Average Home Price Across the GTA - January 2023

Increasing Real Estate Investor Down Payment Requirements for Each Subsequent Home:

The second strategy is to make it harder for real estate investors to buy homes. Sometimes, investors buy up a lot of homes and this makes it harder for people who want to buy a home for themselves. One way to do this is to make investors put down a bigger down payment each time they buy another home. This makes it harder for them to keep buying more homes and driving up prices.

Offering First-Time Homebuyers a Tax Incentive for Interest Paid:

The third strategy is to give people a tax break if they buy a home for the first time. This means that they will pay less in taxes if they have a mortgage. This can make owning a home more affordable for people who are having a hard time paying for it.

Conclusion:

Overall, these three strategies can help more people buy homes in Canada. We need to break down the barriers that are stopping people from buying homes and make sure that everyone has the chance to own a home and build a stable future for themselves.