Key Takeaways:

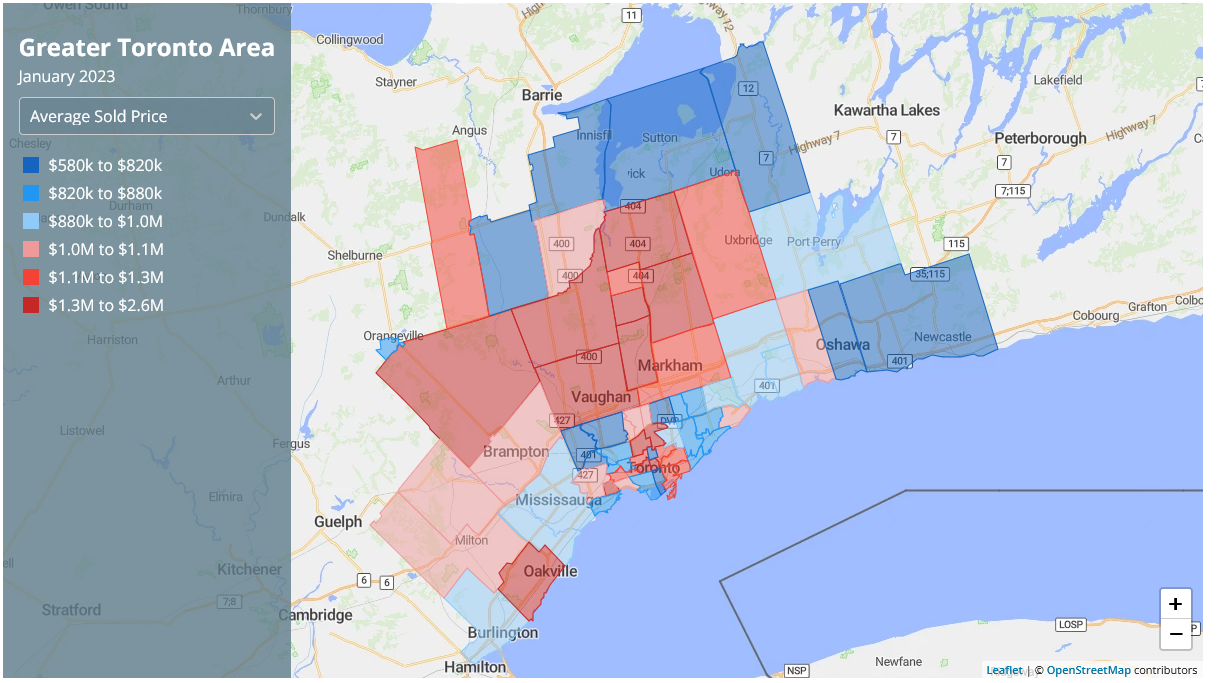

- High housing costs in Canada prevent many from homeownership, with average prices at $612,204 and up to $1,000,000 in Toronto.

- Innovative approaches can improve affordability,

- 40-year amortization can help younger, lower-income Canadians become homeowners.

- Higher investor down payments can level the playing field for first-time buyers.

- Tax incentives for mortgage interest can reduce the cost of homeownership and incentivize first-time buyers.

Personalize Your Blog Experience

Choose your preferred reading level

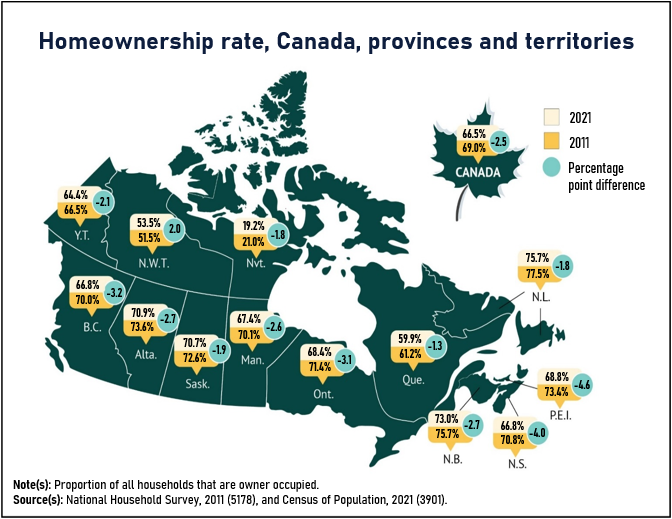

Owning a home is something many Canadians hope to do one day. But with the rising cost of living and home prices, it can be tough for first-time homebuyers to enter the real estate market. In 2021, the average house price in Canada was over $600,000, and in some cities like Toronto, it can be as high as $1 million. This makes it difficult for many Canadians to afford a home. To help address this problem, there are three strategies we can consider that may help more Canadians afford to buy a home.

Offering first-time homebuyers a 40-Year Amortization:

The first strategy is to offer first-time homebuyers a 40-year amortization option for their mortgage. This means that the time period for paying off the mortgage would be spread over 40 years instead of the usual 25 years. With housing prices increasing, it can be hard for many Canadians to save up for a large down payment and meet the income requirements for a mortgage. By offering a 40-year amortization, we can provide more affordable mortgage payments that better align with their income and budget. This would make homeownership more accessible for younger Canadians who are starting out in their careers and may not have the same earning potential as more established homeowners.et have the same earning potential as more established homeowners.

Average Home Price Across the GTA - January 2023

Increasing Real Estate Investor Down Payment Requirements for Each Subsequent Home:

The second strategy is to increase the down payment requirements for real estate investors for each subsequent property they purchase. Real estate investors buying up properties can drive up prices, making it harder for first-time homebuyers to compete. By increasing the down payment requirements for real estate investors, it can discourage excessive real estate speculation and encourage more responsible investment practices. This would help level the playing field for first-time homebuyers and reduce competition from investors who may be less interested in using properties for primary residences and more interested in profiting from rising home values.

Offering First-Time Homebuyers a Tax Incentive for Interest Paid:

The third strategy is to offer first-time homebuyers a tax incentive for the interest they pay on their mortgages. This would help reduce the overall cost of homeownership for Canadians, making it more affordable for those who may be struggling to meet the financial demands of homeownership. Additionally, it would provide a valuable financial incentive to those who may be on the fence about whether to buy or continue renting.

Conclusion:

Overall, these three strategies offer innovative approaches to improving housing affordability for first-time homebuyers in Canada. By providing more accessible mortgage options, reducing competition from real estate investors, and incentivizing homeownership through tax incentives, we can help more Canadians achieve their dream of owning a home. It's important to break down the barriers to homeownership and ensure that all Canadians have the opportunity to build a secure and stable future through property ownership.